Volatility Strategy Pack

A professional Python pack for mastering volatility in any marketOverview

This pack delivers 8 research-based, volatility trading strategies, each implemented in clean, well-documented Python. Designed for systematic traders and quants who want more than basic indicators, every strategy is accompanied by sample backtest code (.py), and documentation.

What’s Inside: Volatility Strategies That Matter

- Empirical-Mode Decomposition Channels: Adaptive price channels using EMD to reveal hidden cycles in price action. Detects regime shifts and sets dynamic entry/exit bands for trading both trends and reversals.

- HAR-Model Volatility-Forecast Breakout: Uses the Heterogeneous Autoregressive (HAR) model to forecast volatility and sets dynamic breakout levels. Trades volatility expansions based on advanced, research-proven forecasts.

- Intraday Volatility Breakout: A robust intraday system triggering trades when price breaks above or below opening range by a volatility-adjusted threshold, exploiting daily volatility surges.

- Volatility Momentum: Captures acceleration or deceleration in market volatility by measuring momentum in rolling standard deviations—goes long volatility when it's expanding, short when compressing.

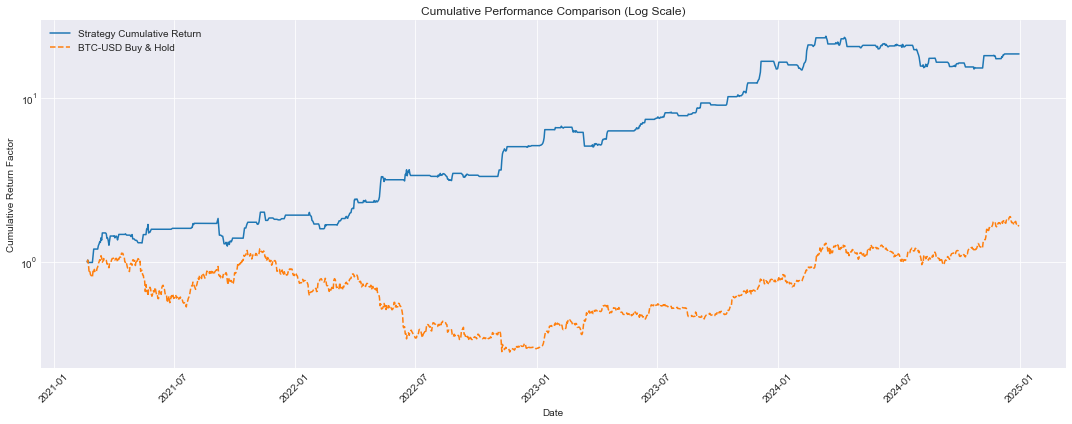

- Volatility Ratio Reversion: Identifies mean-reversion opportunities when short-term volatility diverges sharply from long-term volatility. Trades for normalization after volatility spikes or drops.

- Volatility-Clustering Reversion: Leverages volatility clustering: trades for mean reversion when realized volatility reaches local maxima/minima, exploiting periods of volatility contraction and expansion.

- Volatility-Oscillator Divergence: Pairs a price oscillator with realized volatility; trades on divergence signals to filter out false momentum and avoid crowded trades.

- Wavelet-Decomposed Volatility Bands: Uses wavelet transforms to build sophisticated bands around price trends—detects volatility regime shifts on both high- and low-frequency components.

What You Get

- Full Python source (

.pyformat) - Sample backtest with data and example configs for each strategy

- PDF manual explaining logic, parameters, and usage

How It Works

Import a strategy, load your data, set your parameters, and launch a backtest or live trade. Use it with Backtrader, or adapt to any Python trading framework.

Performance Snapshots

Example metrics for a simplified sample backtest for BTC-USD (results vary by asset, timeframe, and parameterization):

- --- Vol Ratio Reversion (Trend SMA 50, ATR SL 1.0x14) ---

- Cumulative Return: 18.66x

- Annualized Return: 83.25%

- Annualized Volatility: 38.80%

- Sharpe Ratio: 2.15

Documentation & Support

- PDF manual for all 8 strategies (download)

- Ongoing code updates and email support

Get the Volatility Strategy Pack Now

Download instantly and level up your systematic volatility trading. Lifetime updates and direct support included.

Purchase Now!